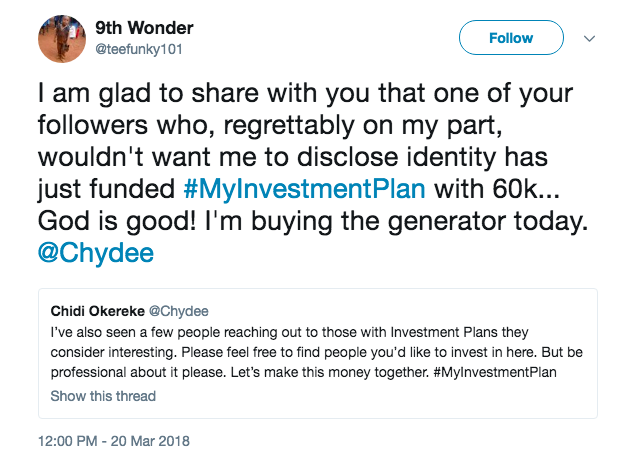

#MyInvestmentPlan has been trending on Social Media for a while now, and a lot of people are discovering ways to invest their money. From agriculture to car wash, laundry, food and beverage businesses, people are sharing their ideas and getting funding from @InvestmentOne, the guys behind the campaign and other random investors.

Now, they say when you invest, you are paying for a day when you do not have to work. They also say regular investment will improve how you live in the future. It is therefore necessary to invest, so your future can be brighter. Problem is, a lot of people do not know how to go about it. Luckily for us, the brilliant people at Investment One have put together a report of the top 10 places you can invest in in Nigeria.

We have summarized in this listicle, but you can get the full report HERE.

Enjoy, and share to bless someone.

-

Treasury Bills

“Treasury bills tend to be risk-free as they are backed by the guarantee of the Federal Government.”

-

Commercial Papers

“While commercial papers (CP) are similar to T-bills, they tend to be slightly riskier and fall under the fixed income investment category.”

-

Sovereign Debt Issuance Or Sovereign Bonds

“The wholesale Sovereign Bond issuance at the primary auctions has a minimum investment value of N50 million, whilst the retail issuance minimum bid size is N5,000.”

-

Sub-National Or State Bonds

“State Bonds are dependent on the issuer rating and the tenor. They also often have an Irrevocable Standing Payment Order to guarantee payment of bond obligations.”

-

Corporate Bonds

“Corporate Bonds are riskier than FGN Bonds and tend to pay a higher coupon rate.”

-

Eurobonds

“The fact that Eurobonds are issued in a foreign currency, provides a hedge against exchange rate fluctuation of the domestic currency for investors, while being exposed to all other risk factors associated with bond investing.”

-

Equities

“In 2017, the Nigerian equities market returned +42.30% following three years in which the Nigerian Stock Exchange had recorded negative returns.”

- Mutual Funds

“Mutual funds give small or individual investors access to professionally managed portfolios of equities, bonds and other securities, which are diversified and provide a relatively stable return.”

-

Real Estate

“Real estate investments are historically proven to provide a hedge against inflation.”

-

Venture Capital

“Though it can be risky for investors who fund startup companies and small businesses, the potential for above-average returns is an attractive payoff.”

***

Which of these would you invest in? Get the full report HERE and flourish.