Earlier today, Tuesday, January 27, 2026, Nigerian fintech Paga announced a partnership with PayPal, allowing Nigerians to link their PayPal accounts to Paga wallets. For the first time in nearly two decades, Nigerians can receive international payments and withdraw funds in Naira, a development that could change the way freelancers, gig workers, and small businesses handle cross-border payments.

PayPal’s restrictions on inbound transactions in Nigeria date back to around 2004, when concerns about fraud led the global payments platform to limit Nigerian accounts to “send-only.” For years, Nigerians could send funds abroad but were unable to receive payments, a situation that affected freelancers, content creators, and businesses who relied on international clients. Paga’s CEO noted that the journey to this partnership started with an email pitch to PayPal in 2013, showing over a decade of persistence before the deal finally materialized.

Nigerians’ Reactions: A Mix of Hope, Skepticism, and Pride

The online response to the partnership reveals a nuanced landscape of sentiment. Nigerians are weighing the benefits of easier payments against historic grievances with PayPal and the strength of local alternatives.

1. Memories of Lost Funds

Many Nigerians recall instances where PayPal restricted or permanently limited accounts, often freezing or confiscating funds without adequate explanation. Freelancers and small businesses lost hard-earned money, sometimes thousands of dollars, leaving lasting frustration.

2. The Stigmatization Feeling

The long-standing restrictions painted Nigerian users broadly as fraud risks, despite many legitimate account holders. This collective labeling created deep resentment, as users felt punished for circumstances beyond their control.

3. Too Late for Many

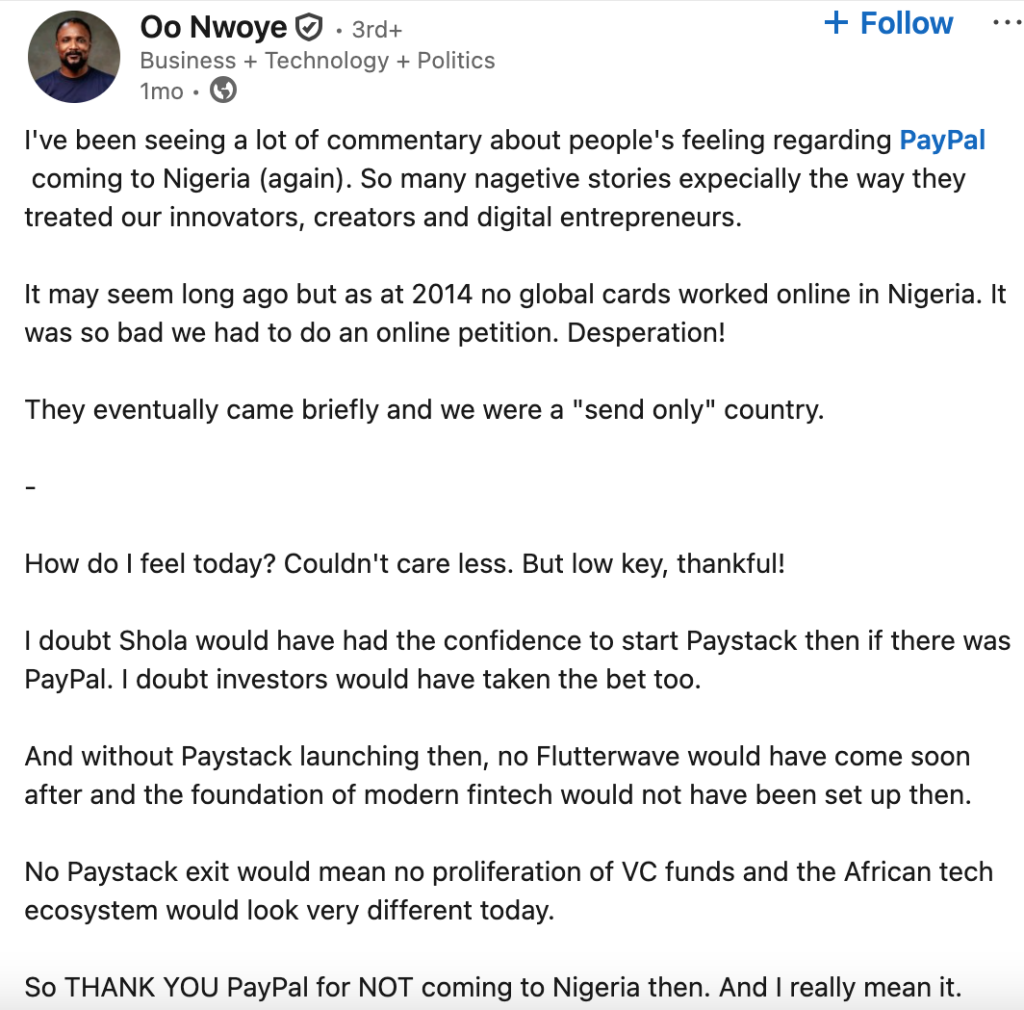

In PayPal’s absence, local fintechs (e.g., Paystack, Flutterwave) and other global options filled the gap, enabling international payments more reliably. Many feel Nigeria adapted and thrived without PayPal, making their return opportunistic rather than helpful.

This shows that support for the fintech itself is intertwined with opinions about PayPal.

4. Mixed Views on Paga

While Paga is praised by some for persistence (their CEO shared a 2013 email pitch to PayPal), others criticize high fees, past service issues (e.g., hacks, poor support), or see the deal as Paga profiting from a controversial partner. This has sparked backlash against Paga too.

This has fueled emotional pushback, even against Paga, which is seen as partnering with a brand many feel wronged them.

5. Pride in Local Innovation

Finally, many Nigerians highlight the resilience of the local fintech ecosystem. Despite PayPal’s absence, local platforms enabled international transactions, proving the country’s capability and innovation.

This sentiment reflects a mix of optimism for new opportunities and pride in homegrown solutions.

Final Thoughts

The Paga-PayPal partnership is live, offering Nigerians access to international payments. While some welcome the convenience, public sentiment remains mixed. Skepticism lingers due to past account restrictions and lost funds, and pride in local fintech solutions shapes cautious optimism.

A key theme online is the call for accountability and transparency. Users want PayPal to address past freezes and losses before broad adoption can follow. Ultimately, the partnership’s success depends on restoring trust and showing a genuine commitment to Nigerian users.